Bitcoin Monthly Analysis

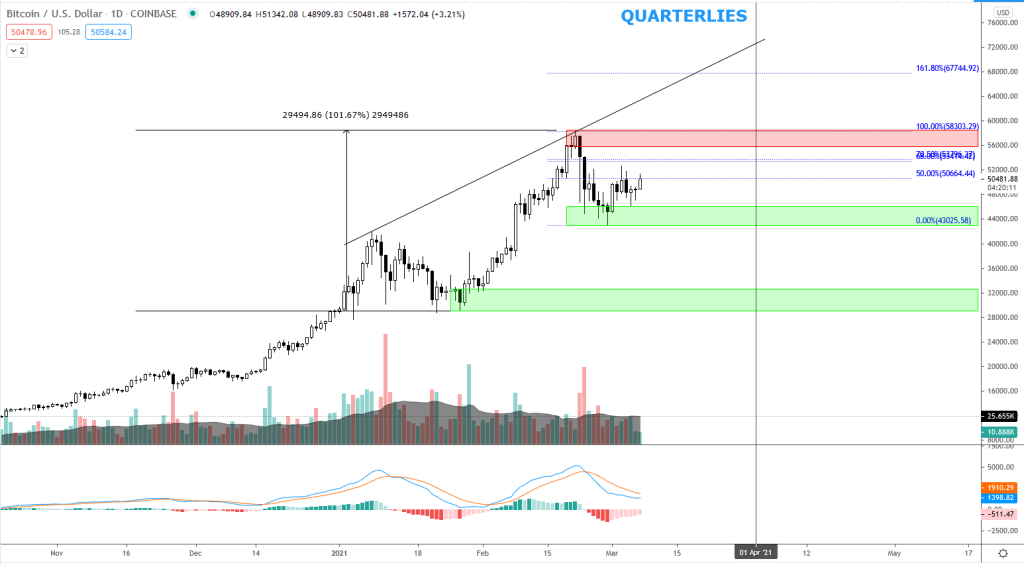

Rounding up a huge quarter for Bitcoin with growth of up to 100% from the beginning of the year we take a look at few technicals that might give us some clues as to what the Cryptocurrency Markets have in store for investors.

FLOWS & MINING DATA

In terms of mining data we see a steady increase of hashrate which indicates the network is still growing and will continue to be secure as miners show continued support for the Network.

In terms of miners outflows we see a continued higher outflow of Bitcoin to exchanges however in price terms they seem to be creating short term tops. Miner’s outflows are not bearish unless we see panic selling as price starts making new lows. Currently there are no alarm bells ringing even though miner outflows are on the high side.

Supply is extremely limited on exchanges currently, which signals the fact that demand is still high even at these prices. Coinbase continues to see outflows of Bitcoin, this simply means investors are buying and storing in cold wallets as part of a longer term hold and investment strategy.

Transaction fees are rising slightly which has signalled tops in the past, however we are no where close to the fees seen in the macro top in 2017. The transaction volume is very high which is probably a result of investors buying and transferring coins to wallets as well as the strong outflows from miners as they off load their coins.

As see in the figure below we are relatively far away from any top signals.

GENERAL NOTES

In terms of cycles we are currently approaching the close of Quarterlies at the End of March as well as the Expiry of Options for March. These events have in the passed normally brought new swing lows and excellent buying opportunities.

Investment firms and funds will need to rebalance their portfolios as the quarter comes to an end to realise profits for their clients. Normally these types of events are brought on towards the 2nd half of the Month. What has also become a major pattern are the amount of options being traded currently, the options closing out over the last few months have created some major volatility and excellent scalping environments for day traders.

March has never been a great month for Bitcoin as most monthly closes in March show negative or small growth, one thing that stands out are the 2nd quarter numbers. After all derivatives close out its time to buy. Second quarter results for Bitcoin are very high and we can look at the charts to find some great entries and look for obvious targets.

TECHNICALS

In terms of Technicals in the charts Bitcoin is still trending and Price Action is still very bullish on Higher Time Frames.

Upside Target of around $64 000 to $67 000 dollars is on the cards. The Sell side pressure seems to be dwindling as indicated by the MACD and a close above $52 000 will indicate that bulls are still in cotrol.

PROJECTS TO LOOKOUT FOR

March the 11th FTX Exchange will be hosting an Initial Coin Offering. Details about the IEO as well as Info regarding the Project can be found here.

FTX will launch the Oxygen IEO at 9pm Singapore time on March 11th. OXY is the native token for the Oxygen Protocol.

Oxygen is a DeFi prime brokerage service built on Solana and powered by Serum’s on chain infrastructure. Oxygen is built around Pools — Baskets of assets that take collective actions. Starting with a borrow-lending facility, users will be able to earn yield and get leverage against their portfolios, setting the foundation for a vibrant and decentralised financial ecosystem.

Please carefully read https://help.ftx.com/hc/en-us/articles/360057486611 on how to participate in the Oxygen pre-sale.

FTX is a cryptocurrency exchange built by traders, for traders. FTX offers innovative products including industry-first derivatives, options, volatility products and leveraged tokens.

This monthly analysis has been compiled by Joe Zabbs.

For more from Joe, please follow on social media (Twitter: @joezabb, Youtube Channel, Discord)